Triveni Turbines is a market-leading corporation, with core competencies in the areas of industrial heat & power solutions, along with decentralised steam-based renewable turbines up to 100 MW size.

Triveni Turbines has 50+ years of experience and expertise in manufacturing and assembly of engineered steam turbine solutions, designed to meet the growing heat and power requirements of industrial customers across the globe. As one of the market leaders focussed on delivering industrial heat & power solutions, and decentralised steam-based renewable turbines up to 100 MW size, the Company plays a pivotal role in the industrial energy sector.

The Company provides its solutions and services to a marquee clientele, spanning major end-user industries like Sugar, Distillery, Cement, Steel, Food Processing, Pulp & Paper, Pharmaceuticals, Petroleum Refineries, Chemicals, Petrochemicals and Fertilisers, etc.

Playing a critical role in meeting the global energy requirements, steam turbines find extensive use in the generation of heat and power from steam. They have emerged as one of the most efficient ways to convert heat energy into mechanical energy, which can be further converted into electrical energy. In the context of Triveni Turbines, whose customers also include decentralised renewable energy providers, particularly in areas where there is a lack of access to the main power grid or unreliable power supply, steam turbines are also used in conjunction with renewable energy sources. Along with solar or geothermal energy sources, they provide reliable and clean energy to users. Decentralised power generation refers to the production of electricity closer to the point of consumption, enanbling enhanced energy efficiency and reliability, reduced transmission losses & costs, and promotion of energy security. By using steam turbines in combination with solar, geothermal or waste-to-energy sources, communities can generate clean and reliable energy, while reducing their dependence on fossil fuels and augmenting their energy security and resilience.

Triveni Turbines has a large global footprint, which it continues to expand through its strategic investments. The Company manufactures steam turbines at its world-class manufacturing facilities in Peenya and Sompura at Bengaluru, India, and assists its customers with their aftermarket requirements through its global servicing presence. It is continually scaling its customer-centric approach through a robust service network spread across India, and having international offices in Europe, Middle East and Africa.

The Company has also established a dedicated office and repair facility in the USA to support its comprehensive product and service offerings in the region. By delivering responsive support across time zones, Triveni Turbines is reinforcing customer trust across global markets, and ensuring top-of-the-mind brand recall for its growing client base.

New technology development is the key engine of the Company’s portfolio expansion strategy. Triveni Turbines collaborates actively with stakeholders to pioneer new manufacturing and service solutions for a wide range of industries. It is also advancing its energy transition efforts through the development of CO2‑based technologies for energy storage, heating and cooling applications using heat pumps and chillers.

The World Energy Outlook 2024 report by the International Energy Agency (IEA) has reported a 15% increase in the global demand for energy over the last decade. Rising population, increase in economic activity, and industrial output in emerging market and developing economies are the key factors driving the demand. Of the total demand increase, 40% has been met by clean energy (renewables), nuclear and low-emission fuels, including Carbon Capture, Utilisation and Storage (CCUS). This has led to a decline in the share of fossil fuels in the global energy mix - from 82% in 2013 to 80% in 2023. As the world moves towards a more renewables-rich energy system, the fossil fuels usage is further expected to decline to 75% by 2030, and below 60% by 2050.

The World Energy Outlook 2024 also pointed out that the total final energy consumption (TFC) across end-use sectors increased by 1.7% to 445 exajoules (EJ) in 2023. This increase was split between industry (beyond 170 EJ or 38%), buildings (~125 EJ or 28%), transport (~120 EJ or 27%), and agriculture & other non-energy users (around 25 EJ or 7%). The TFC is expected to climb steadily by 1.3% per year till 2030, in line with the trend of the last 10 years.

As the most energy consuming and CO2 emitting end-use sector, industry accounts for 38% of TFC and nearly 50% of CO2 emissions globally. Energy-intensive sectors, such as chemicals, iron and steel, cement and aluminium, dominate this demand. Regionally, energy demand growth is concentrated in the emerging economies, while advanced economies are focussing concertedly on efficiency improvements and clean energy adoption.

Recent years have seen a decline in the energy intensity of the global economy on account of technological progress, efficiency improvements, and changes in the structure of the global economy. Growth in renewables and increasing electrification of end-uses play an important role in boosting the efficiency of energy systems. The annual investment in energy efficiency exceeded USD 390 billion in 2023, up from USD 300 billion in 2020. Many major economies have adopted legislative and policy measures to steer further efficiency gains in the coming years. These measures include the Inflation Reduction Act in the United States of America (USA); the Energy Efficiency Directive in the European Union; the revised Act on Rationalising Energy Use in Japan; and the most recent cycle of the Perform, Achieve and Trade scheme in India.

Though electricity demand in advanced economies remained subdued in 2024, robust growth in developing countries sustained global consumption. According to IEA’s Electricity 2024 report, global electricity demand was projected to reach 29,000 TWh in 2024, driven by an improving global economic outlook and a resurgence in industrial activity across both advanced and emerging markets.

Renewable energy continued its strong momentum, generating an estimated 11,300 TWh, constituting approximately 40% of the global electricity in 2024. This is expected to rise to over 17,000 TWh by 2030, marking a significant milestone toward a cleaner energy future.

Propelled by the rapid expansion in renewable energy, the power generation sector is at the forefront of the global transition towards net-zero emissions. However, reduction of global CO2 emissions remains a key challenge in this transition.

In response to growing energy demand and the imperative to cut emissions, the power sector is undergoing a profound transformation towards cleaner, more sustainable energy sources. This marked shift is expected to accelerate going forward, as countries and corporations intensify their climate commitments.

The significant demand in energy in recent years is attributable to the country’s rapid economic growth, industrial expansion and urbanisation. This has catalysed a stronger emphasis on sustainable development and climate-focussed policies.

According to MOSPI’s Energy Statistics for India 2024, the country experienced a healthy growth of 6.5% in consumption of energy from 33,018 Petajoule (PJ) in 2021-22 to 35,159 PF in 2022-23(P). India’s power sector has also undergone significant transformation, aligning with the global energy trends. As of March 31, 2025, of the country’s total installed electricity generation capacity of 475.21 GW, renewable energy accounted for 43%, according to the Central Electricity Authority (CEA). This milestone achievement reflects India’s growing commitment to clean energy and steady progress towards a sustainable future.

Biopower, comprising biomass and biogas, has further emerged as a strong driver of the clean energy transition, contributing an additional 11.58 GW, and playing a crucial role in converting agricultural and organic waste into energy and further diversifying the renewable mix.

Biopower, comprising biomass and biogas, has further emerged as a strong driver of the clean energy transition, contributing an additional 11.58 GW, and playing a crucial role in converting agricultural and organic waste into energy and further diversifying the renewable mix.

These developments are reducing India’s reliance on fossil fuels, and advancing its shift to a more resilient, low-carbon energy system. They are aiding the nation in its journey towards achieving 500 GW of renewable energy capacity by 2030, with expectations of a continually accelerating transition toward environmentally sustainable “Green Power” solutions.

A major energy consumer, the industrial sector requires power for machinery, heating, cooling and various operational processes. Triveni Turbines offers efficient solutions tailored to various industrial heating and cooling needs. The current limited adoption of renewable energy in this sector highlights a significant opportunity to develop robust steam turbine generator systems.

Driven by the Government’s ‘Make in India’ initiative, the industrial sector is emerging as a high-growth area. Rising input costs, particularly energy expenses and stricter regulations, are prompting investments in captive power plants to ensure reliable, cost-effective and sustainable energy supply. Captive power generation has assumed a major significance for manufacturers, especially those vulnerable to grid disruptions. The high cost of industrial electricity, improved coal availability, growing awareness of renewable alternatives, and supportive green energy policies are expected to accelerate captive power capacity expansion in the country.

Industries such as cement, steel, petroleum refining and chemicals, are key drivers of this demand. Captive power units provide operational flexibility, utilising both fossil fuels and renewable sources – including hydro, solar PV, wind, bio- power, waste-to-energy, waste heat recovery, concentrated solar power and geothermal energy.

As a key player steering energy transition, Triveni Turbines offers steam turbine solutions that utilise low-pressure steam from extraction turbines for heating applications, enabling simultaneous production of heat and electricity. This cogeneration approach reduces power generation costs by 14–15% compared to Independent Power Producers (IPPs). Unlike solar power, which operates only during daylight hours, cogeneration provides continuous energy, effectively meeting a plant’s combined heat and power needs, thus lending a distinct advantage to manufacturers.

The rising demand for electricity, along with a growing emphasis on biomass energy, waste-to-energy solutions and waste heat recovery, is propelling sustainable and cost-efficient power generation through cogeneration technologies. This remains a major area of investment and focus for the turbines industry in general, and Triveni Turbines in particular.

According to industry reports, the global steam turbine market declined at a CAGR of 0.7%, from 108 GW in 2014 to 101 GW in 2024. In 2024, the global steam turbine market, grew by 13% year-on-year, at the back of increased electricity demand and growth in utility turbines. Excluding China and Japan, the market grew by 68% year-on-year, supported by rising demand in industrial heat and power solutions.

The beyond 100 MW range constitutes 93% of the overall market and is driven by the utility turbines.

Triveni Turbines operates in up to 100 MW industrial steam turbines market. In 2024, its addressable market (ex-China and ex-Japan) declined by 12% year-on-year to 5.5 GW. Within this, the sub-30 MW range saw a decline of 5% year-on-year, while in the 30.1 to 100 MW range, the decline was at 20% year-on-year.

Over the past decade, Triveni Turbines has consistently outperformed broader market trends, reinforcing its market leading position. The Company’s performance has been driven by the growing demand for industrial heat and power in its target markets, and its increasing market share. Its growth in market share has been built on a foundation of strong and continuously evolving research, development and engineering capabilities.

A customer-centric approach, with a strong focus on product performance and lifecycle cost, has enabled Triveni Turbines to set industry benchmarks in turbine efficiency, durability and uptime. This has led the Company to rank among the top two globally, in a technically challenging market traditionally dominated by large multinationals. Triveni Turbines also holds a leading position in renewable-fuel-based segments, including biomass, Waste-to-Energy (WtE) and Waste Heat Recovery (WHR).

Source for exhibits: McCoy Report 2024

FY 25 was a good year for the Company’s Products business, as product order booking achieved an impressive growth of 38% y-o-y, increasing to ₹ 17.41 billion. The growth in product order booking was led by finalisation of orders in the renewable energy sector, industrial clients, power producers and API turbines. Domestically, the Company’s strategic foray in CO2 energy storage solutions further pushed its product order booking. In the API segment, the enquiry base expanded geographically, resulting in order finalisations for both drive and power turbines across the Middle East, Southeast Asia, Central & South America and Europe. As a result, the Company achieved its highest-ever annual product order booking for the fourth consecutive year, representing a key milestone in its pursuit of sustainable and innovative solutions.

In FY 25, Triveni Turbines crossed a significant milestone with the award of a turnkey contract for a CO2-based energy storage system (ESS) project by NTPC. The project offers discharge cycles well beyond the typical 2 to 4 hours of lithium-ion batteries. Leveraging industrial-grade mechanical components, such as turbines, compressors and pressure vessels, the system provides a location-agnostic and durable (20 years or more) energy storage alternative to other long duration (8 hours or more) systems such as pumped hydro storage. Absence of dependency on critical minerals (e.g. lithium, cobalt, nickel, manganese, etc.) make this a sustainable alternative to conventional Battery Energy Storage Systems (BESS). Successful demonstration of this system could unlock substantial opportunities in the energy storage sector, opening new horizons of growth for the Company.

A robust enquiry pipeline and global diversification provide strong visibility for Triveni Turbines’ sustained and sustainable future growth.

In FY 25, the Company’s international enquiry pipeline grew by ~30%, while the domestic enquiry growth was even more impressive at ~120%, lending Triveni Turbines a high visibility for the coming year.

The IPP segment emerged as the largest contributor to the Company’s overall enquiry base, followed by the process industries, sugar & distillery, steel and the oil & gas sector (API – Drives and Power Turbines). The API enquiry base also expanded geographically, resulting in order finalisations for both drive and power generation turbines across the Middle East, Southeast Asia, Central and South America, and Europe.

Aligned with its mission to maximise performance and efficiency, the Company’s aftermarket team delivers end-to-end support across the entire lifecycle – from initial commissioning to continuous performance optimisation. Triveni Turbines employs advanced technologies and proven methodologies to ensure that its turbines and other rotating equipment operate at optimal performance and reliability throughout their service life. The team continuously evaluates customer operations to offer tailored, value-added upgrades and efficiency improvement solutions. These initiatives not only enhance the turbines’ operating performance but also support customers in optimising their overall processes.

A notable increase in new, repeat and referral orders resulted in robust growth for the Aftermarket business in FY 25. The business reported 19% year-on-year growth in revenue during the year. This performance endorsed the Company’s strategic initiatives towards diversification of revenue streams and mitigation of associated risks.

A significant contributor to the segment’s performance over the last couple of years has been the major services contract for large utility steam turbines in South African Development Community (SADC) region, secured in FY 23. The successful maintenance and overhaul of these turbines reduced power outages and alleviated load-shedding in the region. As a result, the demand for outage-related services declined, causing the order book to grow at a muted 1% on a year-on-year basis. Adjusted for this contract, the order booking for Aftermarket segment registered a healthy growth in FY 25.

The segment’s positive growth trajectory underscores its deep-rooted strength, along with the solid demand and successful execution strategies that have driven significant advancements in both order inflow and revenue generation. The Company’s focus on expanding its global presence and diversifying into various sectors positions it well for improving the segment’s contributions to the overall growth in the upcoming years.

In its Aftermarket division, the Company aims to position itself as the premier provider of comprehensive lifetime service solutions for its clientele, underpinned by a robust culture of innovation, operational excellence, safety and quality assurance. As a multi-brand service entity, the Company capitalises on its extensive expertise to service turbines and other rotating equipment of all manufacturers.

Triveni Turbines’ core objective is to deliver timely maintenance services and spare parts support, ensuring that customers achieve optimal performance levels from their products. This commitment to customer satisfaction is facilitated through the deployment of innovative business models, as well as hybrid asset integration and optimisation strategies. The Company continues to make proactive investments towards enhancing its customer outreach and service proposition.

Triveni Turbines strong “customer-centric” approach in its manufacturing, supply chain and logistics operations has emerged as a key priority over the years. The Company’s core principle is to not only meet the rising demand but also to remain aligned with the dynamic quality and delivery standards emerging from diverse industrial sectors, market segments and geographical locations. Its efforts begin with a thorough analysis of customer requirements, followed by systematic feedback collection and assessment of satisfaction metrics from various interactions and deliveries collected through multiple touchpoints.

Triveni Turbines has instituted a structured customer complaint resolution process that ensures prompt communication of site-related feedback to relevant internal stakeholders and partners, including suppliers. This strategy promotes timely issue resolution and horizontal deployment of best-in-class features. A similar methodology is applied to customer satisfaction (C-SAT) and Net Promoter Score (NPS) surveys, which help align the Operations team with the impact of their output on customer experience, while also remaining agile to the shifting market demands.

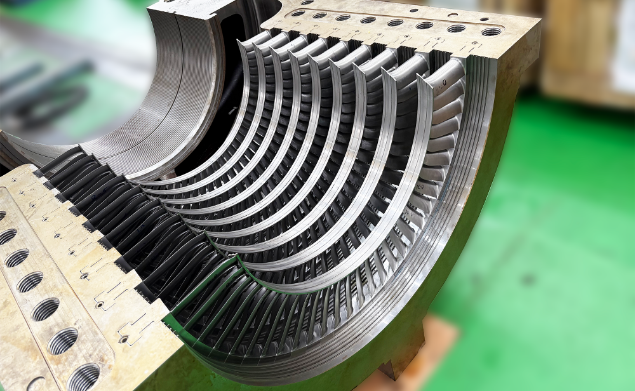

Led by the insights into the customer expectations, the Manufacturing teams at Triveni Turbines are engaged in the production, assembly and testing of industrial steam turbines up to 100 MW, including API turbines, at its world-class facilities in Bengaluru. Establishment of in-house capabilities for critical component machining, covering blades, nozzles, rotors and casings, is backed by rigorous testing protocols using state-of-the-art machining, inspection and testing infrastructure. This helps Triveni Turbines promote manufacturing excellence across the product value chain.

The Company focusses on manufacturing drive and power turbines, specifically for the Oil & Gas sector, complying with API-611 and API-612 standards. Having secured prestigious orders from major oil companies in the Middle East, Triveni Turbines’ manufacturing and supply chain teams have expanded the supplier base to meet the authorised vendor lists of these companies. The teams have gone further, to enhance the capabilities of existing and new suppliers and subcontractors for compliance with rigorous inspection, testing and validation processes. The Operations team has also strengthened its capacity to execute the larger turbine projects, in the higher power range, for which the Company is now securing an increasing number of orders.

The International Monetary Fund (IMF) has projected the global GDP at 2.8% in 2025 – a downward revision influenced by escalating geopolitical tensions, policy divergence, and rising trade frictions between nations. Despite these global headwinds, India’s economic outlook remains robust, with the IMF projecting the country’s GDP growth at 6.5% for FY 26, Key drivers of India’s growth will be strong domestic demand, infrastructure expansion, and policy-driven investments in energy and sustainability.

As a globally trusted energy innovator, Triveni Turbines is well-positioned to sustain healthy performance in the medium-term. The Company’s strong order backlog in API and IPG (Industrial Power Generation) turbine segments, as well as market expansion in high-potential regions such as USA, supports this outlook. A robust domestic supply chain further enhances competitiveness and ensures business continuity.

Additionally, the Aftermarket business presents strong growth potential, driven by a large portfolio of offerings, including spare parts, services and refurbishments targeting a wider customer base across steam, utility and geothermal turbines. The Company’s expanding international footprint, coupled with the increasing electricity demand for renewable thermal energy particularly in waste-to-energy and decentralised power solutions, further augment the growth opportunities.

Triveni Turbines is in a sweet spot to harness these trends to drive long-term growth and profitability across both domestic and global markets.

The inaugural order for a CO2-based long-duration energy storage system secured during FY 25 marked a transformative milestone in the Company’s commitment to sustainable energy solutions. This groundbreaking project positions Triveni at the forefront of innovative storage technologies, offering a promising alternative to conventional battery systems. The venture lays the foundation for future advancements, showcasing the Company’s dedication to pioneering solutions that align with global decarbonisation goals. As it embarks on this journey, Triveni Turbines remains optimistic about the role CO2-based storage will play in shaping a resilient and sustainable energy landscape.

Led by its sustained focus on being perceived as a ‘Company with Conscience’. Triveni Turbines actively and continually strives to contribute to the social and economic development of communities. It seeks to benefit the deprived, underprivileged and differently-abled individuals through impactful programmes. The Company’s philosophy is guided by its belief in ‘doing well by doing good’. It firmly believes that the long-term success of a corporation depends on giving back to society and ensuring its operations are sustainable.

It is Triveni Turbines’ continued endeavour to improve the lives of people, and provide opportunities for their holistic development through its initiatives in the areas of Healthcare, Education & Training, and Technological Development. The Company planned and implemented a series of CSR programmes in FY 25, with focus on generating the maximum positive impact on target beneficiaries. These initiatives were undertaken in partnership with credible implementing agencies.

Led by its commitment to good corporate citizenship, the Company strives to be a socially responsible organisation, and strongly believes in development that is beneficial for the society at large. Its intent is to make a positive contribution to the society in which it operates and thrives. In order to leverage the demographic dividend of the country, the Company’s CSR efforts are focussed on Health, Education, Employability and Environmental interventions for the relevant target groups, ensuring diversity, and giving preference to needy and deserving communities in urban India.

Triveni Turbines works toward integrating social and environmental concerns into its business operations. The Company demonstrates enhanced commitment at all levels within the organisation to operate its business in an economically, socially and environmentally sustainable manner.

The consolidated financial results of the group for FY 25, in comparison with the previous year, are summarised below. The statements have been prepared taking into account the results of TTL’s subsidiaries, namely: Triveni Turbines (Europe) Pvt. Limited (TTEPL), a wholly-owned subsidiary based in United Kingdom, Triveni Turbines DMCC (TTDMCC), a wholly-owned subsidiary based in Dubai, Triveni Turbines Africa (Pty) Ltd (TTAPL), a wholly-owned subsidiary based in South Africa, India-based Triveni Energy Solutions Limited (TESL), TSE Engineering (Pty.) Ltd (TSE) based in South Africa (70% controlled), and Triveni Turbines Americas Inc (TTA) based in the United States of America. TTA was set up in FY 24 in the State of Texas, USA, for augmenting the business of industrial steam turbines and rotating industrial machinery in the American region. Further, the consolidated financial statements include the performance [accounted by using the equity method] of the joint venture (50% controlled) Triveni Sports Private Limited (TSPL).

These subsidiaries enhance the corporate visibility for Triveni Brand at a global level, thereby helping the group in expanding its market reach through better market understanding, enhanced customer trust and loyalty, access to international resources, compliance with local regulations, and adaptation to local cultural and business practices. The outlook of subsidiaries of the Group, particularly international, continues to be positive.

TTL has chosen to showcase its financial review for consolidated financial results to present a holistic view of the group’s financial performance.

These summarised financial results are based on the consolidated financial statements that have been prepared in accordance with Indian Accounting Standards (Ind AS), notified under the Companies Act, 2013 (“the Act”), and other relevant provisions of the Act.

The Revenue from Operations, at ₹ 20,058 million for FY 25, marked a growth of 21.3% as compared to FY 24, due to an all-round strong performance, including product, aftermarket and exports. The EBITDA of ₹ 5,177 million is higher than the previous year’s EBITDA of ₹ 3,810 million, showing an increase of 35.9%. EBITDA margins improved by ~280 bps to 25.8% in FY 25 as against 23.0% in FY 24, primarily due to higher realisation in international sales.

Revenue from Product sales increased by 22.2%, and Aftermarket sales by 19.4%. Higher revenues from international markets contributed to the overall improvement in revenues by 21.3%. The revenue in Product as well as in Aftermarket sales segments is shown below:

Triveni Turbines has established a robust Enterprise Risk Management framework and policy. The Company’s robust risk management system ensures identifying, prioritising, mitigating and monitoring the risks and opportunities amidst business environment volatility and uncertainty. It further mandates having a contingency plan for high-rated risks, with trigger points defined for the activation of the business continuity plan. The Company’s strong governance mechanism ensures the achievement of organisational goals and growth, resulting in holistic value creation for its customers. Triveni Turbines ensures sustained strengthening of its risk practices through continuous learning, improvement, and stakeholder participation, including employees.

At Triveni Turbines, risk management is a fundamental part of order-to-remittance (OTR) and other key decision-making processes. The Company has implemented a well-defined procedure for identifying and treating risks during the bidding stage, ensuring mitigation at early stages and strengthening of risk management practices. The Company ensures conducting all major business initiatives following a holistic assessment of all ensuing risks and opportunities. It ensures ongoing investment in new technologies and products, with due consideration of the risks associated with entering new business lines. Furthermore, the risks associated with the supply chain and technology readiness for new business streams are also evaluated and treated.

More recently, the establishment of a subsidiary in Houston, Texas, and the new tariff regime imposed internationally, have exposed the Company to uncertainties relating to sustaining supply chain efficiencies. The Company is undertaking proactive control measures to navigate the challenges. It further remains focused on spreading awareness amongst prospective customers about the Company’s capabilities in the new geography.

The Company has defined key leading indicators to quantify and monitor risks and formulate control measures to address the major challenges it faces. These Key Risk Indicators (KRIs) empower managers with risk analytics to better understand the risk trends and the effectiveness of the control measures. By embedding proactive and sustained risk management, the Company has strengthened its ability to deliver sustainable growth and fulfil stakeholders’ expectations. Guided by a well-calibrated risk appetite, the Company maintains the right balance between effectively balancing threats and growth opportunities that are being explored.

Triveni Turbines continues to invest in the development of energy-efficient products, as well as products with reduced carbon footprints. It is focussed on catering to the ever-increasing demands of the growth segments (thermal renewables, oil & gas). The Company’s new product development team has been successfully innovating new products in the renewable market space, and follows a structured methodology to foster technology readiness.

Like any other capital industry, Triveni Turbines’ business is dependent on the health of the world economy. The Company is venturing into alternate product development to diversify its product basket, empowering it to de-risk the impact of the economy on its revenue growth. It continues to track macro-economic factors, and make tactical adjustments as needed.