The demand for energy services continues to witness continued growth, fuelled by the expanding global economy and population. The 1.3% increase in global energy demand in 2022 was a clear demonstration of this trend, and was in line with recent averages. The increase took place despite the fluctuations in prices and other indicators triggered by the global energy crisis.

As per the World Energy Outlook 2023 report by the International Energy Agency (IEA), the current total final energy consumption (TFC) stands at 442 exajoules (EJ), and is split between industry (167 EJ or 38%), buildings (133 EJ or 30%), transport (116 EJ or 26%), and other end-users (27 EJ). This is expected to rise by 1.1% per year till 2030.

Being the most energy consuming and CO2 emitting end-use sector, Industry accounts for 38% of TFC and 47% of CO2 emissions (including emissions from electricity and heat) globally. Energy intensive industries – Iron and Steel, Chemicals, Non-metallic Minerals, Non-ferrous Metals and Paper – have high-temperature needs and long-lived assets, and account for almost 90% of the demand for coal used in Industry, more than 70% for oil used in the industry, and almost 55% for natural gas. This necessitates the development and deployment of more energy-efficient technologies. Other industries (non-energy-intensive industries), which include light industries such as Food and Textiles, have lower temperature needs and account for the remaining 30% of the demand in the Industry sector.

The worldwide energy landscape is undergoing rapid transformation amid the shifting focus towards renewable sources, propelled by the imperative of climate objectives and the necessity for sustainable energy transitions. According to the World Energy Outlook 2023 report, the proportion of fossil fuels in the global energy mix is likely to diminish, from approximately 80% over the last two decades to 73% by 2030, as a result of the shift towards renewable energy sources. By 2050, the contribution of renewables to the global power generation mix could expand to 45-50%, up from 25-30% in 2030.

The Power sector is vital to the global economy, supplying electricity essential for lighting and appliances across the world. It is responsible for the generation and distribution of electricity sourced from a diverse range of inputs, including renewables such as biomass, wind and solar, as well as fossil fuels, nuclear energy, among others.

With the escalating demand for energy and the need to curb carbon emissions, the Power sector is undergoing a profound shift towards cleaner and greener energy sources. This transition is poised to gain momentum in the coming years, as nations and corporations strive to fulfil their climate objectives and forge a path towards a more sustainable future.

Recent years have witnessed a considerable surge in India’s energy demand, driven by the rapid economic expansion, industrial growth, and urban development. At the same time, the country’s Power sector has seen significant shifts, in line with the global scenario. This has been marked by enhanced focus on sustainable power development and increased emphasis on addressing climate change concerns through eco-friendly policies. There is a growing expectation that the sector will experience a greater shift towards eco-friendly “Green Power” solutions in the future.

According to the Council on Energy, Environment and Water (CEEW), the peak power demand in the country continued to rise in FY 24. It reached a new high of 240 GW in Q2 FY 23 and consistently surpassed the 200 GW mark in all quarters. In energy terms, the average monthly electricity demand (met) saw an uptick of 7.9% in FY 24 (versus FY 23).

In FY 24, the total installed power generation capacity reached 442 GW, of which 143.6 GW (32.5%) came from renewable energy (RE) and 46.9 GW (10.6%) from hydro. Coal capacity in the installed capacity mix dropped below 50% (217.6 GW, 49.2%) in FY 24.

According to the Council on Energy, Environment and Water (CEEW), the peak power demand in the country continued to rise in FY 24.

The Industrial sector accounts for energy consumption in manufacturing plants, such as refineries, mining operations, and other industrial processes that involve the use of energy for machinery operation, heating, cooling, and various industrial operations.

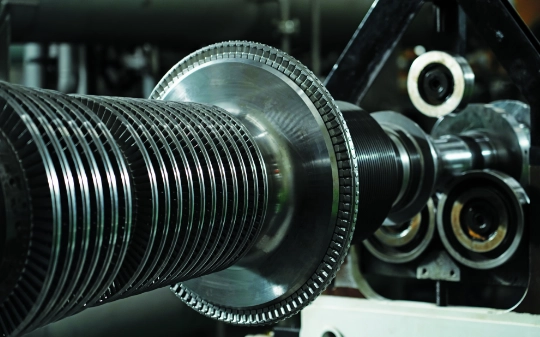

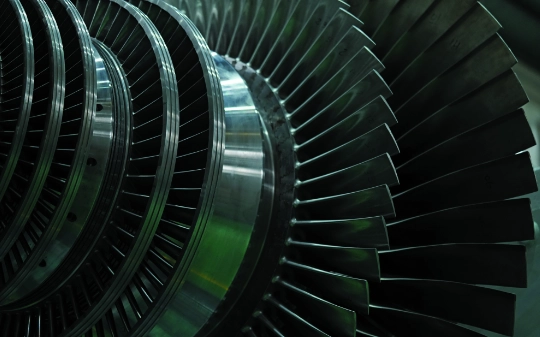

The global steam turbine market has witnessed a decline of 4% per annum, from 120 GW in 2013 to 81 GW in 2023. This is largely attributable to a 5% per annum decline during the period 2013-2023 in the >100 MW market category (utility turbines – accounting for 90% of the overall market). This category decline is attributable to the fast-paced transition to renewable and clean energy technologies from coal-based power technologies in countries across the globe.

In 2023, the global steam turbine market grew by 2% year-on-year, steered by growth in utility turbines and increased global demand.

Triveni Turbines operates in the industrial steam turbines market below 100 MW, and in 2023, this segment ex-China and ex-Japan, grew by 3% year-on-year. Within this, the <30 MW or smaller range market has seen a marginal decline of 0.4% CAGR, while in the 30.1 to 100 MW range, the market has seen a decline of 4.9% CAGR.

However, it is important to highlight that the Company’s concentrated market is ex-China and ex-Japan. And in 2023, the global steam turbine market (below 100 MW), ex-China and ex-Japan, grew by 3% year-on-year, on the back of growth in the decentralised steam-based renewable turbines, further driven by the increased global demand in industrial heat and power solutions.

Triveni Turbines operates in the industrial steam turbines market below 100 MW, and in 2023, this segment ex-China and ex-Japan, grew by 3% year-on-year.

In 2023, the Indian Steam Turbine market for sub-100 MW continued to grow, with the demand for heat and power from the Industrial segment being the key contributing factor.

The market was primarily driven by thermal renewable based power plants (including biomass, waste heat and WtE), followed by fossil fuel fired power plants. Majority of the steam turbines’ requirement in 2023 came from power generation applications (using MSW, biomass, waste heat and fossil as the fuel), and from energy-intensive segments like Steel and Cement, besides segments like Sugar, Distillery, Food Processing, Pulp and Paper, Chemicals and Oil & Gas for CHP applications.

With the manufacturing sector on a growth trajectory, the demand for steam turbines is expected to remain robust in the future, owing to investments in increasing the production capacities among industries such as Sugar, Distillery, Steel, Cement, Pulp and Paper, Food Processing and Chemicals.

FY 24 saw a healthy performance by Triveni Turbines in terms of the overall order booking, which was up by 10% compared to the previous fiscal, and reached ₹ 12.61 billion. The growth in product order booking was primarily driven by finalisation of orders from renewable, industrial customers, power producers and API turbines. The Company touched yet another milestone in its history by recording the highest order booking consecutively for the third year. Notably, this booking has grown at an impressive CAGR of 42% from FY 21 to FY 24.

In the international market, the Company registered growth in product order booking in FY 24 over the previous fiscal. Key milestone orders were closed in both small and large power ranges in regions like Europe, East Europe, Central & South America and North America. In the domestic market, however, the Company registered decline in product order booking growth compared to FY 23. The team at Triveni Turbines managed to offset this decline by increasing the order booking in the international markets - a significant positive development in the current scenario. Triveni’s API enquiry base is spreading across geographies, and the Company was able to finalise orders from both drives and power turbines in FY 24 from regions like Asia and East Europe, to name a few.

It is committed to providing full-service support throughout a turbine’s life-span, from its initial commissioning to ensuring successful performance over its lifetime.

In FY 24, the Aftermarket business unit experienced strong growth, owing to a significant influx of new orders combined with repeat orders. This served to further strengthen the Company’s already diversified portfolio of revenue streams dedicated to servicing and optimising turbine performance globally. The Company’s mission is to ensure that turbines operate at maximum capacity. It is committed to providing full-service support throughout a turbine’s life-span, from its initial commissioning to ensuring successful performance over its lifetime.

The success of the Aftermarket business is evident in its order bookings and sales growth, at 34% and 31% respectively, in FY 24. With a growing international footprint and diversification into new industries, the Company is confident that this segment will continue to contribute significantly to its overall growth in the coming years. The Company is also exploring facilities in different regions to promote its reach and capabilities.

The Company’s goal in its Aftermarket business is to be the preferred lifetime service solutions provider for customers, supported by a culture of innovation, operational excellence, safety and quality. As a multi-brand service provider, the Company leverages its accumulated knowledge to service turbines, regardless of their make. Its primary objective is to provide timely service and spare parts support, to ensure that customers achieve the designed performance of their turbines, ultimately leading to increased customer satisfaction. This is achieved through deployment of innovative business models, and hybrid asset integration and optimisation.

Triveni Turbines is expected to maintain its robust business performance in FY 25 in the light of its strong results in FY 24. This expectation is supported by a substantial backlog of orders in renewable, API and IPG (Industrial Power Generation) turbines, along with successful market expansion into regions like East Europe. The Aftermarket business also shows promising growth prospects, bolstered by an expanding range of offerings, including spare parts, services and refurbishments, designed to cater to a broader customer base encompassing steam turbine, utility turbines, and geothermal turbines.

The resilient domestic supply chain provides a competitive edge and ensures business continuity, even amidst global supply chain disruptions and economic uncertainties. India’s economic outlook appears promising, with the lowest probability of recession in FY 25 compared to other developing and developed nations. Led by its inherent robustness, Triveni Turbines stands to benefit from the relatively stronger domestic conditions and other favourable factors such as improved business environment and increased credit availability, which are expected to generate more domestic business opportunities and drive sustained growth.

Despite the slowdown experienced in certain advanced economies and the growing intricacies of international trade, the Company’s expanding presence in global markets, along with the increasing demand for renewable energy, energy efficiency, waste-to-energy (WtE), and decentralised power solutions, continues to present substantial growth opportunities for Triveni Turbines. The Company is confident that leveraging these opportunities, both domestically and internationally, will enable it to maintain growth and profitability in the coming years.

FY 24 marked another notable year for Triveni Turbines with regard to the supply of API steam turbines to the Oil & Gas and Petrochemical industries. These sectors witnessed remarkable growth compared to FY 23, with a substantial backlog of orders being carried forward. The Company’s persistent efforts in these industries have significantly augmented its pipeline to robust levels. Although the domestic API order book experienced a slowdown due to a subdued business sentiment, the growth in FY 24 was predominantly driven by the international API order book. Looking ahead, strong growth is anticipated in both domestic and international markets within this segment.

Keen to be perceived as a ‘Company with Conscience’, Triveni Turbines strives actively and continually to contribute to the social and economic development of the communities for the benefit of the deprived, underprivileged and differently abled persons. The Company continues to endeavour to improve the lives of people, and provide opportunities for their holistic development through its initiatives in the areas of Healthcare, Education & Training, and Technological Development.

Triveni Turbines philosophy is steered by its belief in ‘doing well by doing good’. It is the Company’s firm belief that the long-term success of a corporate depends on giving back to the society, and ensuring its operations are sustainable. All CSR projects/programmes undertaken in FY 24 were conceived and implemented through a focussed approach towards the target beneficiaries for generating the maximum impact. They were undertaken in partnership with credible implementing agencies.

Led by its commitment to good corporate citizenship, the Company strives to be a socially responsible organisation, and strongly believes in development that is beneficial for the society at large. As a corporate citizen receiving various benefits from the society, it is committed to its co-extensive responsibility to pay back to the society in terms of keeping the environment clean and safe by adhering to the best industrial practices and adopting the best technologies, among other initiatives. It is the Company’s intent to make a positive contribution to the society in which it operates and thrives. In order to leverage the demographic dividend of the country, the Company’s CSR efforts are focussed on Health, Education, Employability and Environment interventions for relevant target groups, ensuring diversity and giving preference to the needy and deserving communities inhabiting urban India.

Triveni Turbines works towards integrating social and environmental concerns in its business operations. The Company demonstrates an increased commitment at all levels in the organisation to operate is business in an economically, socially and environmentally sustainable manner.

The consolidated financial results of the group for FY 24, in comparison with the previous year, are summarised below. The consolidated financial statements have been prepared with the results of subsidiaries Triveni Turbines (Europe) Pvt. Limited (TTEPL), wholly-owned subsidiary based in UK, Triveni Turbines DMCC (TTDMCC), wholly-owned subsidiary based in Dubai, Triveni Turbines Africa (Pty) Ltd (TTAPL) wholly-owned subsidiary based in South Africa, Triveni Energy Solutions Limited (TESL, formerly known as GE Triveni Limited) based in India, TSE Engineering (Pty.) Ltd (TSE) based in South Africa (70% controlled), and Triveni Turbines Americas Inc (TTA) based in the United States of America. During the year ended March 31, 2024, the Company incorporated Triveni Turbines Americas Inc (TTA) in the State of Texas, USA, for augmenting the business of industrial steam turbines and rotating industrial machinery in the American region.

Further, the consolidated financial statements include the performance of joint venture (50% controlled) Triveni Sports Private Limited (TSPL). During the year ended March 31, 2024, the Company invested in the said Joint Venture and same has been accounted by using the equity method.

These subsidiaries cater to various needs, such as customer preferences in jurisdiction, financial flexibility, local compliances and enhancement of operational efficiencies, apart from enhancing the corporate visibility for Triveni Brand at a global level. The financial review is presented for Consolidated financial results as it presents a holistic view of the group’s financial performance.

These summarised financial results are based on the consolidated financial statements which have been prepared in accordance with Indian Accounting Standards (Ind AS) notified under the Companies Act, 2013 (“the Act”) and other relevant provisions of the Act.

During FY 24, the Company focussed on improving the maturity of its risk management processes by:

A four-tier competency development plan was developed and implemented to cover various roles. The plan is aimed at ensuring that all employees have a clear understanding of risk management in their respective roles. At Triveni Turbines, risk management has become an integral part of order-to-remittance (OTR) process and other activities that involve key decision-making. The Company was able to undertake major business initiatives with complete assessment of all ensuing risks and opportunities. Potential risk to locking the working capital in the second utility contract in South African Development Community (SADC) region was controlled by actively managing the subcontractor for the work and ensuring that service was delivered to the largest power producer in Africa by complying with their delivery, quality and Environment, Health & Safety (EHS) requirements.

Similarly, the Company evaluated various options to set up operations in North America. These included evaluating mode of set-up (organic vs. inorganic expansion), choice of location, scope of facility, and mix of personnel for running this operation. With the subsidiary set up in Houston, Texas, the Company now focusses on establishing its workshop and spreading awareness about Triveni Turbine’s capabilities in the new geography in the coming year.

To address the major challenges confronting the Company, leading indicators are formulated to quantify & monitor risks, and formulate risk control measures. These Key Risk Indicators (KRIs) provide risk analytics that help managers secure good understanding of the risk trends and effectiveness of control measures.

Proactive risk management has been a key factor in improving the Company’s ability to maintain sustainable growth and fulfil the expectations of stakeholders. This, matched with the Company’s risk appetite, strikes the right balance between the various threats and opportunities explored by Triveni Turbines for mapping its growth path.