The global economy registered a growth of 3.4% in 2022, led by emerging and developing economies (EMDE) reporting a 4.0% growth, followed by advanced economies at 2.7%, according to the World Economic Outlook 2023 report published by International Monetary Fund (IMF). The growth projection for the global economy in 2023 is expected to fall to 2.8%, owing to worsening economic outlook, continued high inflation and geopolitical tensions. The economic growth prospects for the EMDE are projected to be stronger than the advanced economies, at 3.9% in 2023, while the growth forecasts for India and China stand at 5.9% and 5.2% respectively. In sharp contrast to this, the advanced economies are expected to decline to 1.3% in 2023.

Despite the economic outlook, decarbonisation and energy transition efforts continue to gather momentum. In the last few years, Governments across the world have made a host of commitments to sustainability especially in the run‐up to and after the COP26 meeting in Glasgow in 2021 and these remain the bedrock for many energy strategies. In the last year, the world faced an unprecedented energy crisis which affected fuel supply especially natural gas leading to higher energy bills and supply shortages. This energy crisis promises to be a historic turning point towards a cleaner and more secure energy system which will drive greater alignment of economic, climate and security priorities.

Global energy demand has experienced a significant increase over the past decade, driven by various factors. With the growth of population and industrialisation in developing countries, there has been a surge in energy consumption. Additionally, advancements in technology and the increasing reliance on electronic devices have contributed to higher energy demands worldwide. The expansion of transportation sectors, particularly in emerging economies, has also played a role in driving up energy requirements. Overall, the demand for energy has steadily risen, and this upward trend is likely to continue as economies develop and populations grow.

According to Renewables 2022 Global Status Report, worldwide energy demand increased an estimated 4% as economic activity rebounded in 2021. Heating and cooling contribute to 51% the Total Final Energy Consumption (TFEC), followed by transport at 32% and power at 17%. The penetration of renewables was lowest in those sectors that consume the greatest amount of energy. The highest penetration was in the general use of electricity (such as for lighting and appliances but excluding electricity for heating, cooling and transport), which accounted for around 17% of TFEC. Energy use for transport represented around 32% of TFEC and had the lowest share of renewables (3.7%).

The remaining thermal energy uses, which include space and water heating, space cooling, and industrial process heat, accounted for more than half (51%) of TFEC; of this, around 11.2% was supplied by renewables. The industrial sector includes energy consumption in manufacturing plants, refineries, mining operations, and other industrial processes. Energy is used for powering machinery, heating, cooling, and various industrial processes. Triveni Turbines caters to the industrial component of the overall heating and cooling segment, that contributes more than half of the global energy demand and includes both heat and power solutions. The comparatively lower contribution of renewables in the industrial segment highlights the demand potential for companies like ours that have a strong product portfolio and value proposition in the renewable space.

Several demand drivers and trends have shaped the global energy landscape. The transition towards cleaner and more sustainable energy sources has gained traction, as concerns about climate change and environmental sustainability have grown. Renewable energy technologies have seen remarkable growth, driven by declining costs and government incentives. The push for energy efficiency has also gained prominence, as individuals, businesses, and governments seek to reduce waste and optimise energy usage. Moreover, the electrification of various sectors, including transportation and heating, is an emerging trend that is expected to increase energy demand but can lead to a shift towards cleaner energy sources. As the world continues to address the challenges of energy demand, these drivers and trends will shape the future of global energy consumption.

The global power sector which contributes to 17% of TFEC is a crucial part of the global economy, providing electricity needed for lighting and appliances, around the world. The sector is responsible for generating and distributing electricity from a wide variety of sources, including renewable sources like biomass, wind and solar, along with fossil fuels, nuclear energy, etc. With the growing demand for energy and the need to reduce carbon emissions, the power sector is undergoing a significant transformation towards cleaner and more sustainable sources of energy. This transition is expected to accelerate in the coming years, as countries and companies strive to meet their climate targets and achieve a more sustainable future.

During a year of tentative economic recovery, the renewable power sector took a large step forward, deploying a record amount of new capacity and experiencing greater geographic diversification. However, projects continued to be disrupted by supply chain issues and shipping delays, and a global rise in commodity prices led to surging prices for wind and solar power components. Despite the record capacity additions, the trends remain far from the deployment needed to keep the world on track to reach net zero emissions by 2050.

The Indian power generation industry has observed some key trends, like sustainable power development, enhanced focus towards concerns related to climate change, as well as eco-friendly policies. It is largely expected that the industry may witness greater acceleration towards eco-friendly “Green Power” solutions going forward. The past few years have seen India’s energy needs go up exponentially on account of rapid economic growth, as well as overall industrialisation and urbanisation. As per Ministry of New and Renewable Energy (MNRE), as of March 2023, India has total installed power generation capacity of 415 GW – a growth of 5% over March 2022. Of this, 41% share, i.e. 172 GW, is renewable power generation capacity, as of March 2023.

The sector is fast emerging as one of the high growth sectors, driven by the Government’s ‘Make in India’ programme aimed at placing the country on the world manufacturing map. Rising input costs (energy) and electricity prices, coupled with stringent Government regulations, are expected to drive investment in the establishment of captive power plants for continued uninterrupted power supply, leading to sustainable industrial operations.

Captive power generation is emerging as a key requirement for many manufacturing companies, where grid disturbances in power supply can affect the operations. Improvement in coal supply, growing awareness about renewable energy, and eco-friendly power generation policies will enhance the captive power additions in the country. The largest market for captive power generation in the country is the Industrial sector, mainly on account of the increasing demand for electricity from energy-intensive industries such as Cement, Steel, Petroleum Refineries and Chemicals, etc.

Captive power generation units can be fired using both fossil fuel and renewable fuel. The renewable fuel sources comprise non-thermal (such as Hydro, Solar Photovoltaic (PV) and Wind) and thermal (such as Bio-Power, Waste to Energy (WtE), Waste Heat, Concentrated Solar Power and Geothermal Power).

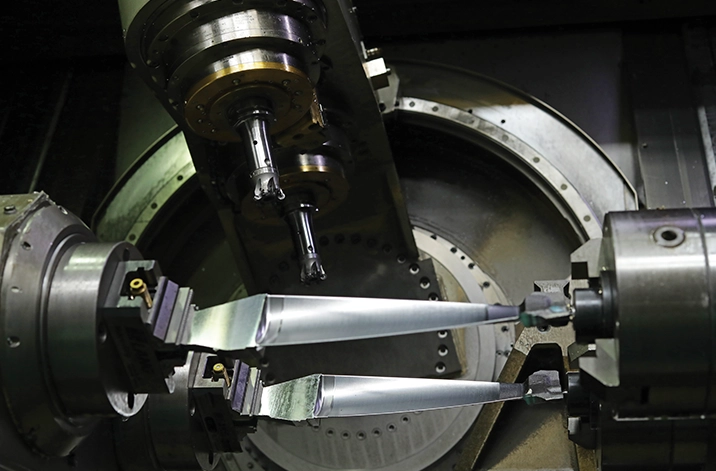

For the last 50 years, Triveni Turbines has manufactured and assembled engineered steam turbine solutions for meeting the heat and power requirements of industrial customers across the globe. The Company is a focussed, growing and market-leading corporation having core competency in the area of industrial heat & power solutions and decentralised steam-based renewable turbines up to 100 MW size. Our customers include end-user industries like Sugar, Distillery, Cement, Steel, Food Processing, Pulp & Paper, Pharmaceuticals, Petroleum Refineries, Chemicals, Petrochemicals and Fertilisers etc.

Steam turbines play a critical role in meeting the global energy requirements. These machines are widely used to generate electricity from steam, and are considered to be one of the most efficient ways to convert heat energy into mechanical energy, which can be further converted into electrical energy.

The global steam turbine market has witnessed a decline of 4% per annum, from 115 GW in 2012 to 74 GW in 2022. This is largely attributable to a 4.7% p.a. decline during 2012-2022 in the >100 MW market category (utility turbines), due to transition to renewable and clean energy technologies from coal-based power technologies in countries across the globe. This segment currently accounts for 88% of the overall market.

In 2022, the overall global steam turbine market grew to 74 GW, up 34% year-on-year driven by growth in the segment of utility turbines driven by increased global demand following a sluggish year due to the pandemic.

Source: Mc Coy Report 2022

Note: Data pertains to calendar years

In 2022, the Indian Steam Turbine market for sub-100 MW range grew 15% (in MW terms) over 2021, whereas the sub-30 MW range grew 22% (in MW terms) over 2021. The demand for heat and power from the industrial segment was the key factor contributing to the rebound in the Steam Turbine market to the 2019 levels.

The market was primarily driven by thermal renewable based power plants (including biomass, waste heat and WtE), followed by fossil fuel fired power plants. Majority of the steam turbines’ requirement in 2022 came from power generation applications (using MSW, biomass, waste heat and fossil as the fuel), and from energy-intensive segments like Steel, Cement, besides segments like Sugar, Distillery, Food Processing, Pulp and Paper, Chemicals and Oil & Gas for Combined Heat and Power applications.

With the manufacturing sector on a growth trajectory, the demand for steam turbines is expected to remain robust in the future, owing to investments for increasing the production capacities among industries such as Sugar, Distillery, Steel, Cement, Pulp and Paper, Food Processing and Chemicals, among others.

Despite uncertainty in the global economy, the Company performed well in terms of overall order booking in FY 23. Finalisation of orders from industrial customers, followed by power producers (along with extended scope offerings) and API drive turbines, led to the higher order booking growth YoY.

The overall product order booking for FY 23 went up by 22% compared to the previous fiscal and reached ₹11.43 billion. This is the highest order booking ever in the history of the Company. Order booking for the product segment has grown at an impressive CAGR of 13% from FY 18 to FY 23.

In the domestic market, the Company registered product order booking growth of 38% compared to the previous fiscal. Key segments of this order intake in FY 23 were Sugar, Distillery, Food Processing, Pulp & Paper, Chemicals and Waste Heat Recovery (comprising Steel and Cement).

In the international market, the Company registered product order booking growth of 7% compared to the previous fiscal. We were able to close some key milestone orders in both small and large power ranges regions like Europe, Africa, Central & South America and North America.

Overall enquiry generation increased 41% YoY in FY 23. Domestic enquiry generation declined by 16% YoY, with the West region garnering the highest enquiry base followed by the South and North regions. In terms of segments, Sugar and Distillery combined contributed the most to the enquiry base, followed by Process industries comprising Food Processing, Pulp & Paper, Chemicals etc., followed by Steel, Cement, IPPs and Oil & Gas (API – Drive Turbines).

International enquiry generation increased by 82% YoY compared to FY 22. Europe generated more enquiries, followed by Southeast Asia and Turkey. Among segments, IPP was the biggest contributor to the enquiry base, followed by Process industries, Steel and Oil & Gas segment (API – Drive Turbines).

A marginal slowdown was noticed in the domestic market and also in the international market (Middle East North Africa - MENA and Central & South America). The TTL team managed to overcome this and increased the enquiry generation, which is quite a positive development in the current scenario. The API enquiry base is spread across geographies, and comes from all the Original Equipment vendors, National Oil Companies (NOCs), EPCs/PMCs.

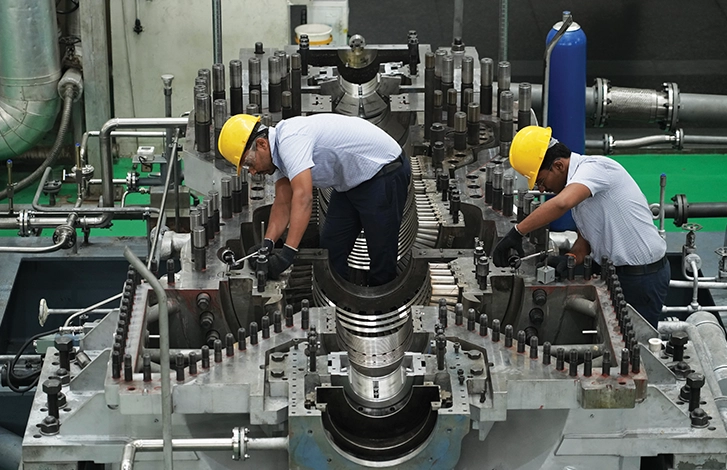

In FY 23, the aftermarket business unit experienced strong growth, thanks to a significant influx of new orders. This has further strengthened the unit’s already diversified portfolio of revenue streams dedicated to servicing and optimising turbine performance globally.

Our mission is to ensure that turbines operate at maximum capacity. We are committed to providing full-service support throughout a turbine’s lifespan, from its initial commissioning to ensuring successful performance over its lifetime.

To reinforce its customer-centric philosophy, the Company has strategically located service offices throughout India, along with international offices in Europe, West Asia, Southeast Asia, and Africa. By providing prompt service support in different time zones, the Company is earning the trust of customers in overseas locations.

We collaborate with various other stakeholders to advance our offerings to the market. Our goal is to be the preferred lifetime service solutions provider for customers, supported by our culture of innovation, operational excellence, safety and quality.

As a multi-brand service provider, we leverage our accumulated knowledge to service turbines, regardless of their make. Our primary objective is to provide timely service and spare parts support, to ensure that customers achieve the designed performance of their turbines, ultimately leading to increased customer satisfaction. We achieve this through the deployment of innovative business models and hybrid asset integration and optimisation.

The success of the aftermarket business is evident in its order bookings and sales growth, which saw increases of 88% and 82%, respectively, in FY 23. With aftermarket contributing to 29% of order booking for the year (up from 21% in FY 22), the Company is confident that this segment will continue to provide a significant share of the overall growth in the coming years.

For Triveni Turbines, the strong business performance for FY 23 is expected to continue during FY 24. This is on account of its strong carry-forward order book and continued development of new market segments of API turbines for Oil & Gas industry, as well as turbines in the higher power range. Prospects for the aftermarket segment are bright as well, with an increasing portfolio of offerings, viz. services, refurbishment and spares, across a wider customer base of steam turbines, utility turbines, geothermal rotors. Strong domestic supply chain guarantees competitive advantage and business continuity, even when global supply chains and economies are going through a rough patch. In order to continue generating value for customers, managing inflation-induced impact will be one of the key areas of focus for the Company.

The outlook for India’s economy is bright, albeit moderate compared to its own past performance. Thus, relatively stronger domestic conditions – higher growth, better conditions for business, credit availability, etc., will create more domestic business opportunities for the Company.

While slowdown in advanced economies, higher interest rates, and increased complexities of trade restrictions pose a challenge to maximise opportunities in international business, the increasing demands for renewable energy, waste to energy (Wte) and decentralised power solutions continue to present significant opportunities for companies like ours, to provide innovative solutions in these areas.

We believe these opportunities, both in domestic and international markets, will help Triveni Turbines sustain growth and margins in the coming years.