DIFFERENTIATING THROUGH INNOVATION

EXECUTIVE MESSAGE

KEY FIGURES

MANAGEMENT DISCUSSION & ANALYSIS

STATUTORY REPORTS

DOWNLOAD CENTRE

India has emerged as the fastest growing major economy in the world and is expected to be one of the top three economic powers of the world over the next 10-15 years. According to the International Monetary Fund (IMF), India has consolidated its position as the world’s fastest-growing major economy. India’s economy is forecast to grow 7.4% in FY 19 from 6.7% in FY 18 and accelerate further in FY 20 to 7.8%, lifted by strong private consumption as well as fading transitory effects of the demonetisation and implementation of the national Goods and Services Tax.

Manufacturing has emerged as one of the high growth sectors in India. The ‘Make in India’ programme is aimed to place India on the world map as a manufacturing hub and give global recognition to the Indian manufacturing. India is expected to become one of the largest manufacturing countries in the world by the end of year 2020.

Under the Make in India initiative, the Government of India aims to increase the share of the manufacturing sector in the gross domestic product (GDP) from 16% presently to 25% by 2022, by creating 100 million new jobs. The improvements in ease of doing business, continuing improvements in infrastructure and skilled workforce should support the spurt in manufacturing activities in coming years.

2017 witnessed changing global energy landscape that has outgrown the traditional centres of demand and has turned its focus to emerging economies and the challenge of meeting the new demands of technology-conscious consumers. The only way to meet the growing demand for change is through innovation and economising the entire business model of energy production as well as its distribution. Digitisation of assets, changing energy mix from conventional sources to renewable sources, eco-friendly policies are key factors working towards an inclusive, environment-friendly energy producing space.

Triveni Turbines provide solutions and services for both Industrial captive and renewable power generation applications globally. Its turbines are used in a wide range of applications such as Cogeneration, Combined Heat & Power Generation, Waste to Energy, Captive Power Generation and Independent Power Generation.

Varied market trends affect the business in different geographies and at different points of time. In the coming section some of the key trends are discussed to give a better view of our addressable market.

Steam turbines cater to the power generation sector like the Utilities and the captive and energy intensive segments like Steel, Cement, or process co-generation sector like the sugar, paper and pulp, chemicals and other process industries. With the expected increase in activities in industries like Steel, Pulp & Paper, Cement and Sugar sector, the demand for steam turbines should remain robust in the coming years.

Globally, the largest market by fuel type is in coal-fired plants and steam turbines market for this fuel type is estimated to grow faster than other fuel type plants such as nuclear, combined cycle and natural gas. The main reason is that many new coal plants are already under construction or planned for future specially in Asia-Pacific region. Steam turbines for Biomass application also holds a significant portion in Asia-Pacific as well as the LatAm & Africa region.

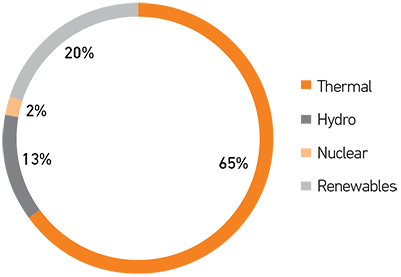

India’s installed power capacity is at 344,002 MW as on March 31, 2018 which includes 20% of renewable power generation capacity. Out of the total renewable capacity of 69,022 MW, around 8,700 MW is from Bio Power and 138 MW from waste to energy. The Government has set a target to achieve renewable power capacity at 175 GW by 2022 which includes 10 GW from biomass power.

The bioenergy potential in the country has been estimated at 25 GW and the Government has been consistently promoting the Biomass Power and Bagasse co-generation programme. Various policy measures have been initiated by the Government including providing financial support to various schemes being implemented by the Ministry of New and Renewable Energy (MNRE), suitable amendments to the Electricity Act and Tariff Policy for strong enforcement of Renewable Purchase Obligation (RPO) and for providing Renewable Generation Obligation (RGO); raising funds from bilateral and international donors as also the Green Climate Fund to achieve the target.

In the Middle East and Africa region, many countries are proactively pursuing renewables to reduce Green House Gases (GHG) through various support mechanisms, such as, renewable targets, renewable portfolio standards (RPS), feed in tariffs (FiTs)/auctions, net metering and tax exemptions/subsidies etc.

As per the industry estimates, globally, around 565 million tonnes of bagasse is produced annually which is used for meeting the energy requirements of the sugar mills and the additional bagasse can be used to generate additional power for sale to the grid. Bagasse based co-generation has been well established in many countries globally especially in the largest sugar-producing countries such as Brazil and India. Many sugarcane producing countries such as Australia, Guatemala, Kenya, Uganda, Vietnam and the Philippines are already generating electricity from bagasse. It is estimated that the power generation potential from bagasse in co-generation process is around 135,029 GWh per year globally and 3,885 GWh per year in Eastern and Southern Africa. Eastern and Southern Africa has estimated potential to double the contribution of electricity produced from bagasse co-generation.

Apart from the traditional Biomass power generation through bagasse co-generation, Waste to Energy (WtE) is a recent source of input for power generation. Residual waste is treated with various Waste to Energy (WtE) technologies for disposal of Municipal Solid Waste and energy generation. The global WtE market is expected to grow steadily till 2023, and it is estimated to be worth USD 40 billion, growing at a CAGR of over 5.5% from 2016 to 2023. Europe is one of the largest market for WtE technologies. Rapidly increasing industrial waste along with stringent EU-wide waste legislation have been the key drivers for the growth of WtE technology in European market. Switzerland, Germany, Sweden, Austria and Netherlands lead installation capacity within Europe. The Asia-Pacific market is also expanding its WtE market rapidly and is estimated to grow at CAGR of 7.5% due to increasing waste generation, higher focus of the Government in China and India and higher technology penetration in Japan.

Combined heat and power production (CHP) is operated to manage the supply of energy by optimising the costs of meeting the demand for electricity and heat. The CHP market is estimated to increase its installed capacity from 755.2 Gigawatts (GW) in 2016 to 971.9 GW by 2025, at a compound annual growth rate of 2.8%. The key market drivers are need for energy efficiency, growing environmental concern, and increasing government incentives and policies to promote co-generation. Asia-Pacific (excluding China), South and Central America, and the Middle East and Africa are expected to be the major markets in the coming years.

Global captive power generation market is expected to grow due to the increasing power demand in emerging markets of China, India, and Middle East and presence of cross subsidised charge to the per unit power generation cost. The largest market for captive power generation globally is Industrial sector which is likely to contribute to the growth of captive power generation market over the next few years. The key growth drivers for this market are increasing demand for metals, chemicals and cement due to rising activities such as construction, development of infrastructure, automotive and electronics industries etc. The installed captive power generation capacity in the country as on March 31, 2018 is 40,726 MW.

One of the largest markets for captive power generation is expected to remain Asia-Pacific on account of robust manufacturing base of aluminium, steel and copper in China and India. Middle East is also expected to be another key growth market for captive power generation due to expansion of petrochemical refining capacity.

IPPs are private entities and one of the primary tier of the power sector, as their sole business is generating power for sale to the grid or specific customers. IPPs may be privately-held facilities, cooperatives or nonenergy industrial concerns focussing on feeding excess energy into the system. A feed-in Tariff or Power Purchase Agreement provides a long-term price guarantee for the majority of IPPs, particularly in the renewable energy industry.