Business Review

Domestic Market

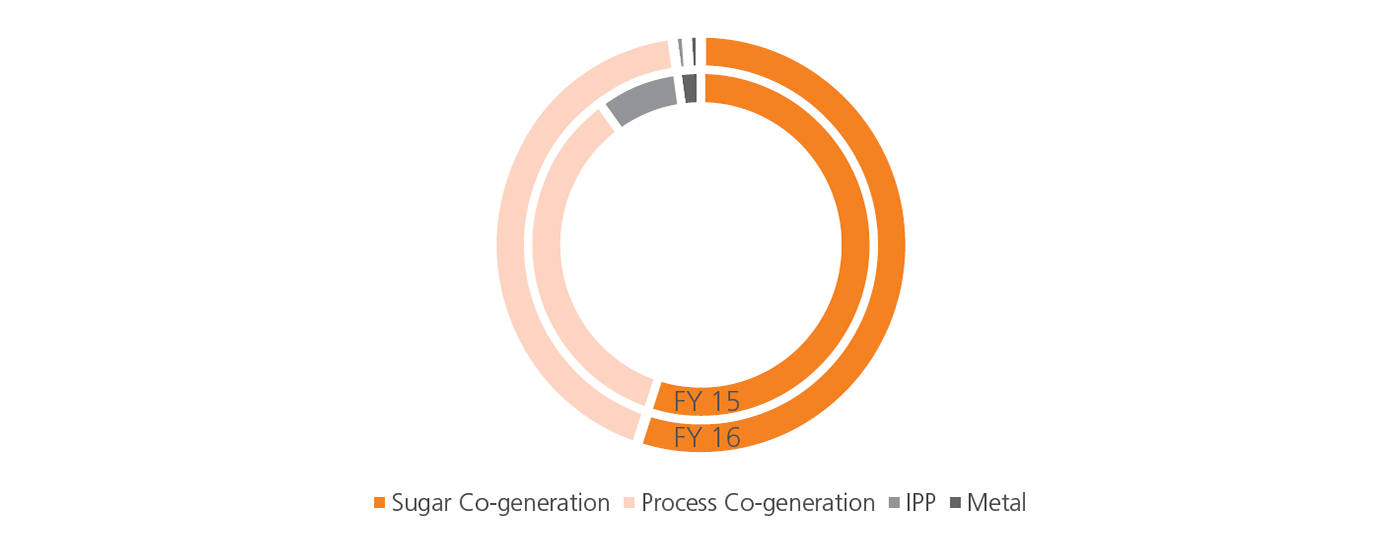

While the Indian Steam Turbine market for under 30 MW size has remained flat for the two consecutive years of FY 14 & FY 15, at around 700 MW of orders booking, the market for FY 16 has shown a decline by about 20%. The main contributor to this decline has been slow order booking in the sugar sector by around 36%, due to stress in the sector and drought in major sugar producing states like Maharashtra, Karnataka etc. However, the Company maintained its share of order booking during the year from sugar co-generation at the levels of the previous year, while the share of process co-generation went up from 35% in FY 15 to 43% in FY 16. Domestic order booking for the Company in terms of value stood at 2.1 billion in FY 16, which is a decline of 19% in comparison to the previous year. The segments from which the Company received orders during the current financial year are:

The Company has a good pipeline of enquiries, which are spread across process co-generation 43%; sugar co-generation 25%; IPPs 12% and metals 20%.

Exports

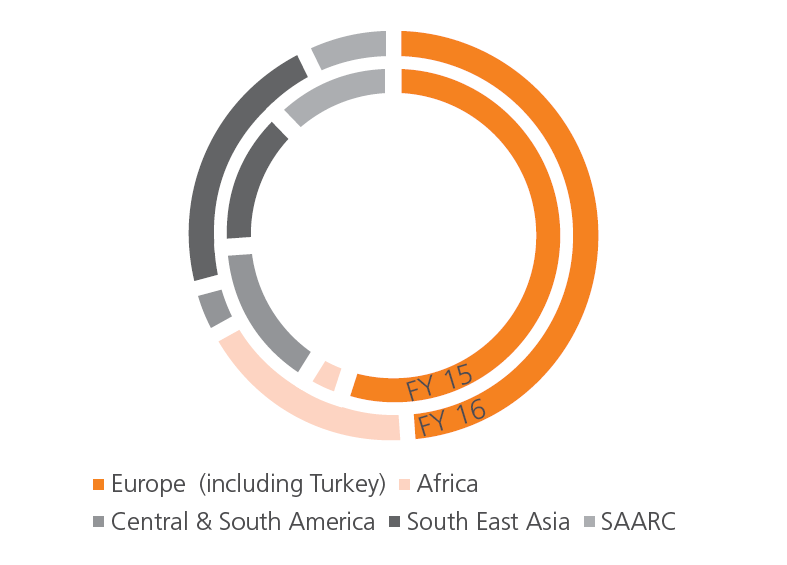

The focus on exports has paid dividends and the Company has started gaining momentum in the export market over the past couple of years. FY 16 has been an excellent year for the international business, with product order booking of 4 billion - a strong growth of 61%. The broad share of export order booking on a regional basis is as under:

The major segments of exports are from renewable, including

waste to energy in Europe and for other markets it has been a

mix of segments such as sugar, paper, apart from renewable etc.

The foray into new markets in Latin America, Africa and certain

European markets, with potential to enter into CIS, North &

West Africa etc., should support the Company’s further growth

in the export market. The Company’s strategy to strengthen its

presence in the existing markets of Philippines & Middle East

regions, achieving higher penetration in Thailand and Korea,

and enhancing market position in Europe, Southern Africa &

South East Asia should also help propel continued growth in

export business going forward. The Company has a strong

enquiry pipeline from over 100 countries.

The Company has been continually focussing on its brand building in various geographies. A key initiative taken in this regard by the Company in FY 15 was to broad-base its international marketing presence by setting up subsidiary companies / offices in strategic locations. This initiative is gaining momentum, with the Company’s presence established in four regions already and some more regions expected to get added in FY 17.

Aftermarket Services

The Aftermarket Services team initiates a partnership with the

customer from despatch of turbine and extending through the

lifetime of the turbine. The nature of aftermarket business is

ongoing and it lays the foundation for good references for

future business.

The Company has a network of service centres strategically

located within close proximity of customers, which ensures

that TTL engineers reach customers’ site faster, thus reducing

downtime. This is being further strengthened with physical

presence in London, Dubai, Indonesia and South Africa. This

will give confidence to the customers, and this locational

advantage can also be leveraged to secure product orders and

long-term service arrangements.

The Company’s foray into refurbishment of other makes of

turbines in a focussed manner has started yielding results,

particularly in international markets. There has been a significant

growth in business from specific regions, and this momentum

will be carried forward with substantial growth planned for the

next few years.

During the year, the order-booking and revenue from this

business segment showed good growth and helped the

Company achieve higher levels of profitability. In FY 16, while

the order booking grew by 14%, the sales increase was

only 7%. However, the share of exports in aftermarket sales

increased by 15%.

Manufacturing Facility

The manufacturing facility of the Company is located on an

11-acre green campus in Peenya Industrial Area in Bengaluru.

The facility is equipped with modern CNC machines and

equipment dedicated to machining of high precision turbine

components, adhering to international quality standards.

The CNC machinery includes 4 and 5 axis vertical machining

centres for blades, mill-turn centres for rotors, and CNC gantry and CNC VTL for casing machining. There are specially

designed test beds for in-site assembling and testing of

turbines, equipped with remote controlled data acquisition

system to automatically monitor the turbine performance

while testing. The facility also boasts of high-speed vacuum

balancing tunnel to carry out precision balancing of all types

of rotors. The facility can produce around 150 turbines per

year. It is certified with ISO 9001 QMS and ISO 14001 EMS

standards, and has adopted excellence in operations through

stringent practice of the principles of TQM, TPM, lean 5S,

Kaizen, QCs, etc.

The Company has also embarked on an expansion plan to

increase the manufacturing capacity of the turbines to 350

per year. It has acquired a 24-acre plot of land in Karnataka

Industrial Areas Development Board (KIADB), Sompura, near

Bengaluru, and has started construction activities at the new

facility, set to be completed in a phased manner. The new

facility has been designed to be a benchmark in turbine

manufacturing, equipped with the most modern shop floor,

R&D facility and a Learning Centre. The first phase of the new

facility is expected to be ready for operations during FY 17.

Technology and R&D

The Company has an advanced in-house R&D department, which is engaged continually in the development of robust, high-power dense, cost-effective and highly efficient turbines to fulfil the requirements of the changing global market. The department has a development roadmap to keep the Company aligned to high international standards with respect to products of global manufacturers in a competitive environment. TTL is becoming a preferred industrial partner for Indian Government-funded programmes, and active proposals are being submitted to MNRE, TERI and Ministry of Power.

The technology developed is extensively validated before commercial use, and the performance parameters in the field are closely monitored to make modifications, as may be considered necessary. Thus, the Company has welldefined processes for development, testing, field feedback and continuous advancement of technology through in-house processes and with global associates.

As in the previous year, the Company was able to develop cost competitive models, with much reduced carbon footprints so as to provide power solutions needed by its diverse international and domestic customers. In line with the industry trends, the Company has been diversifying into different types of steam turbines and other renewable energy products focussing on high efficiency cycles. Even as such products become a reality in the near future, the Company is constantly upgrading and improving its steam turbine designs for optimal performance to meet the increasing power solution requirements from international and domestic customers.

Intellectual Property Rights

The Company’s R&D programme is focussed on technological

upgradations, necessitating safeguard of its Intellectual

Property portfolio. A dedicated team of specialists gets involved

from the planning and conceptualisation stage to the final

product stage.

Over the years, the Company has developed a comprehensive

IP strategy for creation and protection of long-term IP assets to

secure its technological know-how. Reflecting its global focus,

the Company constantly undertakes patent and industrial

design filings in various international markets. The Company

has, in recent times, filed patent applications and design

registrations in India, Europe, South East Asia, and the U.S. In

the future, the Company plans to file patent applications and

design registrations in new international markets which are

catered to by its products.

During the year, the Company made 28 IP filings, thereby

increasing the IP filings in India to 141 and in other countries

to 29 filings. A substantial number of Intellectual Property

Rights have already been awarded to the Company in various

jurisdictions. The Company was also adjudged the winner of the

National IP Award 2016 in the category “Top Organisation for

Designs” by the Ministry of Commerce & Industry, Government

of India.

Supply Chain

Efficient and robust supply chain is one of the critical success factors for the Company. A well-defined purchase policy provides guidelines for the Company’s procurement function encompassing all its key aspects. The emphasis is on cost control, quality, timely delivery, working capital management, consistency and transparency. The Company provides an even playing field to the supply chain partners, sharing with them its annual business plan, market dynamics, as well as new product developments and expectations.

This helps the supply chain partners realign their businesses with the Company’s vision and requirements. In the backdrop of an expanding export market, the supplier partners are encouraged to enhance their capacities so as to reduce the lead time and raise quality standards to meet the global benchmarks. In this process, the Company is working closely with the supplier partners, and provides training to improve their manufacturing process and reduce rejections.

There is a strong realisation and acceptance of ‘Zero Defect’

and ‘Do it right the first time, every time’ concepts by the supply

chain partners and, to ensure the adherence to these concepts,

supplier upgradation programmes are regularly conducted and

suppliers are evaluated using structured parameters & tools.

Existing supplier partners are periodically re-assessed through a

third party agency in order to ensure that the quality standards

are maintained and technology is upgraded in line with the

requirements. For new suppliers, a well-crafted qualification

process is in place along with EHS requirements. All the supplier

partners are governed by a strict code of conduct and nondisclosure

agreements.

The Company has successfully managed its input costs by value

engineering in the designs and materials, developing new cost-effective

supplier partners and sourcing raw materials from

some of the most cost-effective countries around the globe.

The Company’s supply chain always strives to be a value creator

by way of implementing strategic initiatives every year.

Quality Assurance

The Company has implemented a process-based management

structure, where the processes are evolved and owned by

process owners and focussed on customer and continuous improvements. The Company is ISO 9001:2008 certified, with

a sound quality management system integrated throughout

the organisation.

TTL ensures that its network of suppliers and dedicated subcontractors

also comply with these standards through supplier

qualification, QAPs and Standard Operating Procedures (SOPs)

to maintain comprehensive quality control of turbine and its

auxiliary systems.

Products are designed, manufactured and commissioned in

accordance with the International quality norms, such as API,

ASME, AGMA, NEMA and IEC, among others. Systems are

developed to address country-specific product requirements.

These systems have helped TTL to meet the stringent

requirements of export customers, such as CE/PED and GOST

certification.

TTL has adopted the `Zero Defect’ concept to quality, which

is supported by tools and techniques like visual management

system, root cause analysis, followed by CAPA, DWM, DMAIC,

Kaizen, SQIP (Supplier Quality Improvement Programme),

SQDCM, Quality Circles, and a rigorous automated Customer

Complaint Resolution System.

“Kaizen” movement was started in the Company in 2010 to

inculcate a culture of continuous innovation and improvements

throughout the organisation, involving people at all levels.

The movement continues to provide significant benefits in

productivity, quality, cost and EHS. TTL regularly participates in

All India Kaizen events organised by CII-TPM Club of India, and

has bagged several awards.

Human Resource

The Company has adopted diverse methods to build its

organisational capability continuously, which will enable it to

sustain competitiveness in the global market. It believes in

building a robust talent pipeline by inducting fresh engineers

through a structured selection and training programme. This

initiative, which started a decade ago, has yielded good results

in nurturing talent specific to the business. The young engineers

so trained grow with the Company to occupy key roles.

The focus of the Company on development of human resources

has contributed significantly in achieving the business goals,

by building and enhancing technical capabilities amongst

the people through innovative training and improvement

programmes across the functions. This process of engagement

and involvement through ongoing / special projects has created

learning opportunities for the employees. Other initiatives

to foster employee engagement like “Skill enhancement

programme”, “Capability building”, and “Creating future

leadership programme” are also being conducted.

The Learning Centre is the nodal point for both employees

and customers, training them on a continuous basis with

regards to Product and Operations & Maintenance of Steam

Turbine Generator Islands.

TTL believes in providing theme-based annual training to

employees. In FY 16, the theme was “Global Customer

Satisfaction through Process Approach”. Apart from

the “Design, Review, Verification & Validation Training

Programme”, other programmes like “Site Operational &

Diagnostic, supported/assisted by Remote Monitoring System

(RMS)” was introduced for a detailed study of TG Island at

the customer site. This was a significant step in behavioural

assessment of the product. The officers in the Research &

Development and Engineering departments were trained in

this programme, and the RMS has been put to effective use

for product development, including Transient Operational

Regime.

The Company continued with the “Advance Product

Knowledge Upgradation” programme for its Customer

Care Engineers, improvising the behavioural aspects of

the programme with outbound experiential learning. The

“Supplier Quality Improvement Programme (SQIP)”, as part

of “Continuous Improvement” training programme for

suppliers, also continued in FY 16.

Computer-Based Product Training (CBT), including display

models, is an effective and comprehensive self-learning aide

on turbine technology developed by the Learning Centre. CBT module is upgraded on a continuous basis in order to

cover the latest technological changes and bring in innovative

processes.

A total of 2,200 plus man days were dedicated to training

of employees during the year, which was 15% higher in

comparison to FY 15. Similarly, 12,000 plus man-days of

training were provided to the Graduate Engineer Trainees

before being inducted into their relevant departments.

FY 16 also witnessed the induction of Diploma Engineers

for assembling of higher range of turbines, trained at the

Learning Centre.

Environment, Health & Safety (EHS)

During the year, the Company launched an organisation-wide

awareness programme that aimed to improve safety and

security by changing “at-risk” behaviour to “safe” behaviour,

and by fostering a more collaborative working environment.

This included training, coaching and greater accountability

for supervisors, along with broader employee engagement

through peer-to-peer feedback.

The Company’s safety practices have contributed to zero

reportable accidents during the last five years, through

implementation of cross-functional teams that work to remove

risks from the work process. Cross-functional teams comprised

representatives of both labour and management, used

structured protocols to identify methods to reduce or eliminate

workplace hazards.

Safety Culture Change: An assessment was made on the

current state of the organisational safety management system

by an expert organisation working in this field. A review of all

divisions was conducted and recommended for certification

to the standards of OHSAS 18001:2007. The certification is

expected to be completed by October 2016.

Water Recycle Systems: The existing waste-water treatment

system in the plant was renovated for leak-proof water supplies

to the largest zone of landscape irrigation by contributing to

peak demand during summer months.

Industrial Hygiene & Legal Compliance Audits: Ambient

air monitoring study for particulates and gases, ambient

noise monitoring study, and drinking water analysis are being

conducted on regular basis as per the norms specified by the

Karnataka State Pollution Control Board. Results were below

regulatory limits.

Legal and Environmental Audits are part of the

Environmental Management System (EMS) that measures

performance against regulatory and management standards.

The Company’s Environmental Management System (EMS)

is a comprehensive approach to environmental management

and continual improvement, which is certified in line with ISO

14001:2004 standards. Audits are being conducted on half

yearly basis by a reputed organisation, which is recognised by

over 50 accreditation bodies. The Company is complying with

all legal and environmental requirements.

Outlook

Though the Government policies have started bringing positivity in the market sentiment, growth in industrial capex is yet to be seen in the Indian sub 30 MW steam turbine market. The impact of drought on the sugar and biomass industries may affect the order-booking. However, due to lower estimated sugar production for the sugar season 2016-17, the sugar companies are expected to be financially much better off, which in turn may result in capex for co-generation. The trend of projects going on hold is expected to continue for some more time. However, some respite for the market is possible due to increase in demand from process co-generation industries.

It may result in renewal of industrial capex in many sectors, which may boost industrial investment and create favourable business conditions.

In the international market, the economic recovery is expected

to take some more time. The sugar segment, globally, is

expected to see new investment in capex in view of improved

outlook and the reality of demand exceeding supply. The

Company is expected to exploit the under-penetrated markets

as well as new markets. Expansion through global subsidiaries

and increased emphasis on service business (relating not only

to Triveni make, but also other turbines makes) are expected to

help the business growth in the international markets.

The growth potential for TTL in the international market is

huge, as the Company is yet to tap many new geographies and

new segments. With continuous focus, it is expected to keep

the TTL order-booking on a growing trend, offsetting the drop

in domestic market. Some of the segments of focus, going

forward, will be biomass, waste to energy, paper, process cogeneration,

palm oil segment etc.

GE Triveni Limited (GETL)

GE Triveni Limited, a joint venture with General Electric, is a

subsidiary of the Company. GETL is engaged in the design,

supply and service of advanced technology steam turbines with

generating capacity in the range of above 30-100 MW.

GETL offers products, manufactured to international standards

of quality and reliability, with best-in-class efficiencies. The

flange to flange turbine is manufactured competitively at TTL’s

world-class facility located at Bengaluru, and the complete

project is executed by GETL in accordance with GE’s procedures

and processes, which include certification of suppliers,

adherence to environment and other standards.

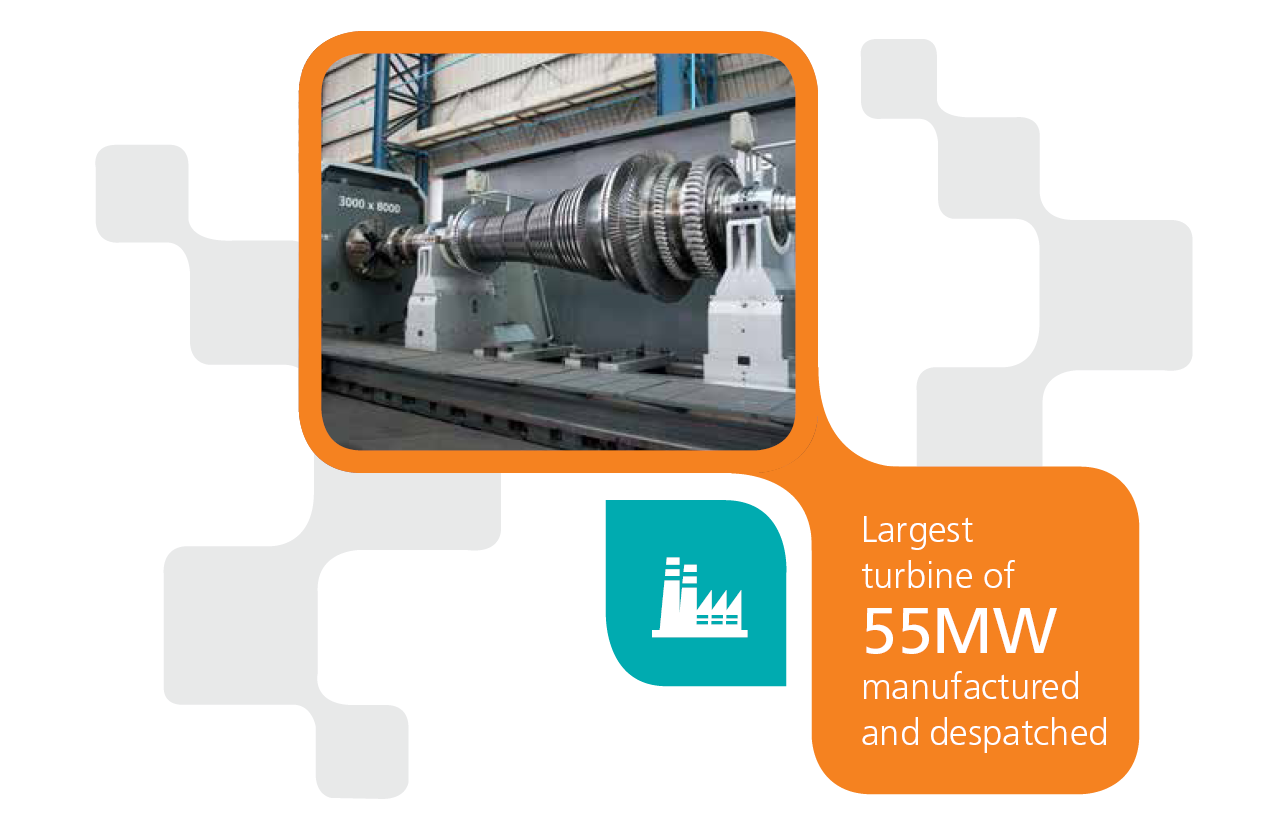

GETL despatched its first large-sized international turbine order

in FY 16, which helped in achieving growth and profits in FY 16

in comparison to FY 15. The despatches of other two turbines,

which is the part of multiple turbines order, got shifted into the

next financial year due to logistics constraints.

On the order-booking front, the JV got a breakthrough order

in a new segment which, upon execution, will help market

the same in other geographies in the future. Similarly, the

commissioning of the large-sized turbines should also help

in getting more orders in the future. The JV has currently a

good pipeline of enquiries, which should facilitate in achieving

a good order inflow in FY 17. The Indian market for the above

30-100 MW segment is yet to see any revival and the Company

believes that there is still some time to revive the domestic

segment of the JV product line.